TCAP StackUp: BasketDAO DeFi Index (BDI)

October 05, 2021 | Mkatx5

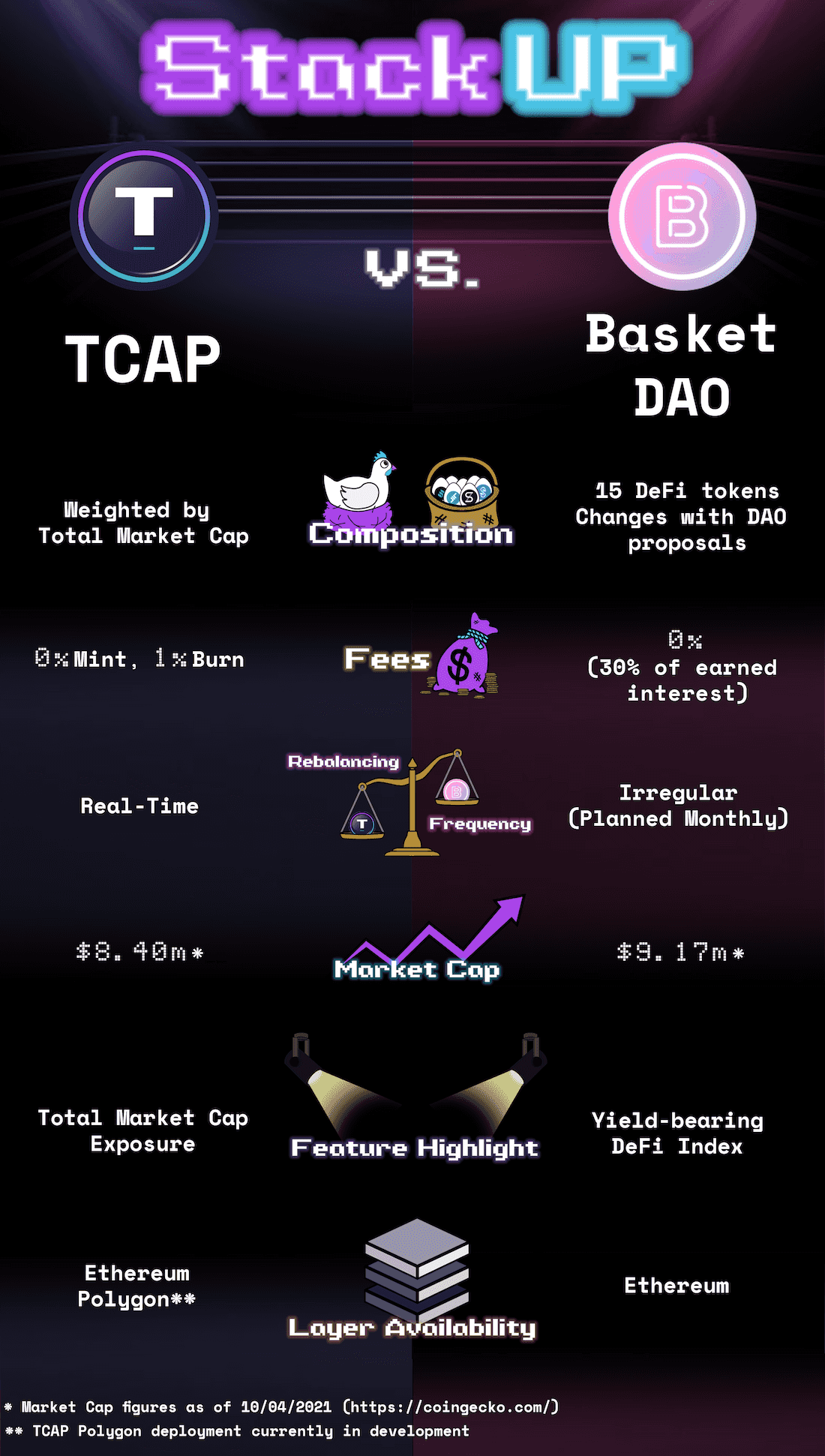

Does the sheer number of different cryptocurrencies make your head spin? Or perhaps keeping track of the taxable events while rebalancing your portfolio and having to shell out for gas fees has you down? Enter crypto index tokens: offering broad crypto exposure, savings on gas fees, and automatic rebalancing - all to make your investing journey easier. However, as always in crypto, there's more than one option to choose from; let's dig into the popular, yield-bearing DeFi Index (BDI) and Total Crypto Market Cap Token (TCAP) to see how they stack up.

StackUp Verdict

BDI & TCAP each come with their own strengths to consider.

- Are you new to crypto or unsure which tokens to buy, but believe in the long-term growth of the crypto asset class and want broad exposure to it? - TCAP might be for you.

- Do you already have an established crypto portfolio and are just looking to specifically round out your DeFi exposure? - BDI could be a good option to consider.

- Do you want to earn passive income on your assets by utilizing various yield farming strategies? - BDI might be a good option for you, but be sure to consider the additional layer of smart contract risk.

- Or perhaps you've called the top of the bull market and you want to open up a short position? - Both BDI and TCAP's minting capabilities offer this to advanced users.

Certainly there are other considerations to keep in mind for your particular situation as well. But when you're evaluating index token options, whether they be BDI, TCAP or something else, make sure you keep these key considerations in the back of your mind. Don't forget to stay tuned into Cryptex for more index token StackUps.

About the Tokens

BasketDAO DeFi Index (BDI)

The DeFi Index (BDI), by the BasketDAO team, is a DeFi index provider that offers users exposure to its underlying tokens, currently 15. In addition, BDI also offers the ability to generate passive income on these assets by utilizing yield farming strategies such as Yearn vaults as well as holding yield bearing tokens (such as cTokens from Compound). 70% of the yield generated from these assets are reinvested into BDI while the remaining 30% of the yield is used to buy BASK and distributed to xBASK holders - a separate project by BasketDAO.

BDI rebalances as needed with the latest allocation holding 15 tokens: UNI, AAVE, MKR, COMP, LINK, and SUSHI account for about 75% of the current index holdings. For more information, visit https://basketdao.org/BDI and https://www.bdpi.live/#bdi.

Total Cryptocurrency Market Capitalization (TCAP)

Total Crypto Market Cap Token (TCAP), by the Cryptex team, is designed to give investors accurate, real-time price exposure to the total capitalization of the cryptocurrency market via a single, synthetic asset. Data from a number of oracles is aggregated in order to establish a total market cap median value, which is then bridged on-chain through an audited Chainlink Smart Contract.

TCAP rebalances in real-time and by design includes everything: DeFi, DeFi Indexes, Stablecoins, Governance Tokens, Asset-back tokens, and wrapped tokens. For more information, visit https://cryptex.finance/.

DISCLAIMER: Any views expressed in this post represent the sole analysis of Cryptex, (“Cryptex”) whose opinions are based solely on publicly available information. No representation or warranty, express or implied, is made as to the accuracy or completeness of any information contained herein. Cryptex expressly disclaims any and all liability based, in whole or in part, on such information, any errors therein or omissions therefrom. Cryptex also reserves the right to modify or change its views or conclusions at any time in the future without notice. Cryptex is an open-source, fully decentralized protocol. Cryptex is NOT an ICO. No sale has been solicited. The information contained in this post DOES NOT recommend the use of any Cryptex token, nor is it an offer to sell, a solicitation, or an offer to buy any Cryptex tokenized asset. Furthermore, CTX token rewards governing the protocol are granted by Cryptex to system providers with a value of ZERO. Always do your own research. The information contained in this post is not intended to be, nor should it be construed or used as, investment advice. No representation, recommendation, or warranty, express or implied, is made as to the future performance or functionality of any Cryptex token. Any unaffiliated use of this document, or the contents herein, is strictly prohibited without the prior written consent of Cryptex.

CRYPTEX IS A FAIR LAUNCH PROTOCOL

- NO ICO

- NO VC FUNDING

- NO PRE-SALE

- CTX TOKENS ARE REWARDED AND ARE NEVER PURCHASED FROM CRYPTEX.